Are YOU facing the home buying dilemma? When is the right time to buy a first home in the North and East Twin Cities Metro? Funny thing is, there is no right answer. We are fortunate in the Minneapolis St Paul area. Homes are affordable for both single people and couples. There are abundant down payment resources available for Minnesota home buyers too.

Today I would like to talk more about the topic: Wondering If You Can Buy Your First Home?

There are many people sitting on the sidelines trying to decide if they should purchase a home or sign a rental lease. Some might wonder if it makes sense to purchase a house before they are married and have a family, others might think they are too young, and still, others might think their current income would never enable them to qualify for a mortgage.

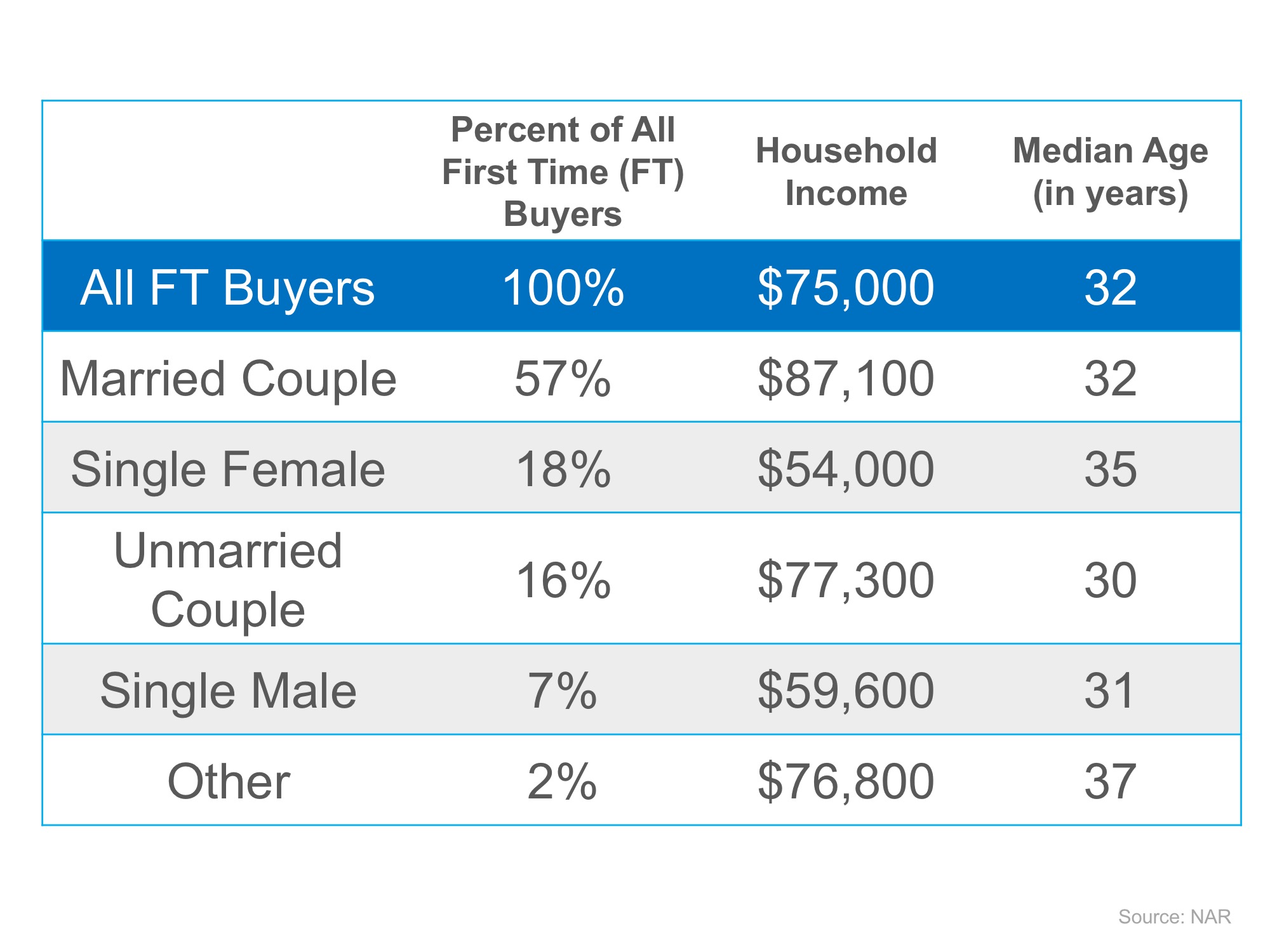

We want to share what the typical first-time homebuyer actually looks like based on the National Association of REALTORS most recent Profile of Home Buyers & Sellers. Here are some interesting revelations on the first-time buyer:

Bottom Line

You may not be much different than many people who have already purchased their first homes. Let’s meet to determine if your dream home is within your grasp.Source: KCM Teri Eckholm Blog

READY

to Make YOUR Move? It IS essential to have a knowledgeable agent at your side. If

you are buying, selling or relocating to Minnesota and need help from a

professional REALTOR®, give me, Teri Eckholm of BOARDMAN Realty, a

call at 651-336-7073 or visit my website for a FREE Home Buyer Success Guide or FREE Home Value Report. I specialize in

acreage and lakeshore properties in the north and east Twin Cities

metro area including Ham Lake, Lino Lakes and all communities in the

Forest Lake School District! Serving Anoka, Chisago, Ramsey and

Washington Counties in Minnesota.

Copyright 2018 terieckholm.com

Copyright 2018 terieckholm.com